Armed with some data from our friends at CrunchBase, I broke down the largest London startup funding rounds during the month of March. I have included some additional information as well such as industry, founding year, brief funding description, founders, total funding raised, to further the analysis for the state of venture capital in London. For the purposes of this analysis, only equity funding rounds were considered.

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (London Tech, NYC Tech, LA Tech, Paris Tech, Boston Tech), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

7. Genesis Global $45.0M

Round: Series B

Description: Genesis Global is a low-code technology platform that helps financial institutions build new applications. Founded by James Harrison and Stephen Murphy in 2012, Genesis Global has now raised a total of $48.0M in total equity funding and is backed by investors that include Citigroup, Salesforce Ventures, GV, Accel, and Illuminate Financial.

Investors in the round: Accel, Citigroup, GV, Illuminate Financial, Salesforce Ventures, Tribeca Early Stage Partners

Industry: Enterprise Software, Financial Services, FinTech, Information Technology, Software

Founders: James Harrison, Stephen Murphy

Founding year: 2012

Total equity funding raised: $48.0M

6. Freetrade £35.0M

Round: Series B

Description: Freetrade is a challenger stockbroker that offers free share trading in mobile phones. Founded by Adam Dodds, Andre Mohamed, Davide Fioranelli, Ian Fuller, and Viktor Nebehaj in 2016, Freetrade has now raised a total of $84.9M in total equity funding and is backed by investors that include Crowdcube, Draper Esprit, L Catterton, Left Lane Capital, and AfterWork Ventures.

Investors in the round: Draper Esprit, L Catterton, Left Lane Capital

Industry: Financial Services, FinTech, Personal Finance, Wealth Management

Founders: Adam Dodds, Andre Mohamed, Davide Fioranelli, Ian Fuller, Viktor Nebehaj

Founding year: 2016

Total equity funding raised: $84.9M

5. Pollinate Networks $50.0M

Round: Series C

Description: Pollinate Networks is a platform that works with banks to create data-driven experiences for merchants and consumers. Founded by Al Lukies, Fiona Roach Canning, Jonathan Hughes, and Tim Joslyn in 2017, Pollinate Networks has now raised a total of $218.0M in total equity funding and is backed by investors that include Mastercard, Insight Partners, NatWest Group, National Australia Bank, and Motive Partners.

Investors in the round: EFM Asset Management, Insight Partners, Mastercard, Motive Partners, National Australia Bank, NatWest Group

Industry: Banking, Financial Services, FinTech, Software

Founders: Al Lukies, Fiona Roach Canning, Jonathan Hughes, Tim Joslyn

Founding year: 2017

Total equity funding raised: $218.0M

Make an impact on your bottom line and drive leads in 2021!

Make an impact on your bottom line and drive leads in 2021!

The AlleyWatch audience is driving progress and innovation on a global scale. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement, lead generation, and thought leadership in front of an audience that comprises the vast majority of key decision-makers in the London business community and beyond. Learn more about advertising to London Tech, at scale

4. Zego $150.0M

Round: Series C

Description: Zego is a commercial motor insurance provider that powers opportunities for businesses, from entire fleets of vehicles to self-employed drivers and riders. Founded by Harry Franks, Sten Saar, and Stuart Kelly in 2016, Zego has now raised a total of $201.7M in total equity funding and is backed by investors that include General Catalyst, DST Global, Target Global, LocalGlobe, and Balderton Capital.

Investors in the round: Balderton Capital, DST Global, General Catalyst, Latitude, Socii Capital, Taavet Hinrikus, Target Global

Industry: Auto Insurance, Commercial Insurance, Insurance, InsurTech

Founders: Harry Franks, Sten Saar, Stuart Kelly

Founding year: 2016

Total equity funding raised: $201.7M

3. Blockchain.com $300.0M

Round: Series C

Description: Blockchain.com is a platform that offers ways to buy, hold, and use cryptocurrency. Founded by Benjamin Reeves, Nicolas Cary, and Peter Smith in 2011, Blockchain.com has now raised a total of $490.0M in total equity funding and is backed by investors that include Lightspeed Venture Partners, DST Global, GV, Digital Currency Group, and Eldridge.

Investors in the round: DST Global, Lightspeed Venture Partners, Vy Capital

Industry: Bitcoin, Blockchain, Cryptocurrency, FinTech, Trading Platform

Founders: Benjamin Reeves, Nicolas Cary, Peter Smith

Founding year: 2011

Total equity funding raised: $490.0M

Please join Similarweb on April 20th to see how Digital Intelligence can help you WIN your market. Hear from our CEO, experience demos, view the latest roadmap, network with the best in the business, and check out the latest digital trends. Plus, discover how Digital Intelligence is helping Microsoft, NASDAQ, Shopify, Mondelez, and many more WIN their market. We can’t wait to see you – virtually, of course. #DigitalEdge2021

REGISTER NOW FOR FREE

2. Starling Bank £272.0M

Round: Series D

Description: Starling Bank is a mobile banking platform that offers personal, joint, and business accounts. Founded by Anne Boden in 2014, Starling Bank has now raised a total of £535.0M in total equity funding and is backed by investors that include Fidelity Management and Research Company, Qatar Investment Authority, Millennium Management, Capability and Innovation Fund, and JTC Group.

Investors in the round: Fidelity Management and Research Company, Millennium Management, Qatar Investment Authority, RPMI Railpen

Industry: Banking, Financial Services, FinTech

Founders: Anne Boden

Founding year: 2014

Total equity funding raised: £535.0M

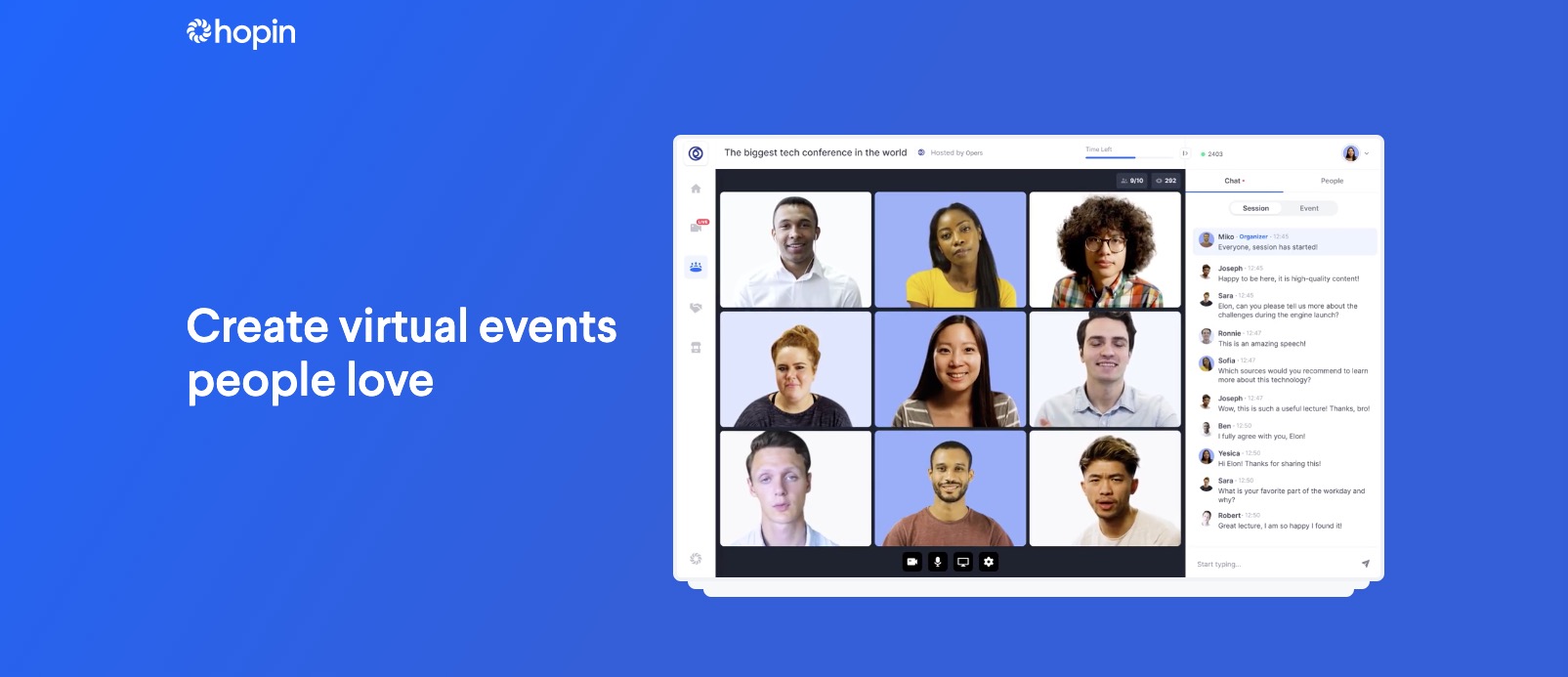

1. Hopin $400.0M

Round: Series C

Description: Hopin is a live virtual events platform where users can learn, interact, and connect with people from around the globe. Founded by Johnny Boufarhat in 2019, Hopin has now raised a total of $571.4M in total equity funding and is backed by investors that include General Catalyst, Salesforce Ventures, Andreessen Horowitz, IVP, and Tiger Global Management.

Investors in the round: Andreessen Horowitz, Coatue, DFJ Growth, General Catalyst, IVP, Northzone, Salesforce Ventures, Tiger Global Management

Industry: Events, Meeting Software, Social Network, Video Conferencing

Founders: Johnny Boufarhat

Founding year: 2019

Total equity funding raised: $571.4M