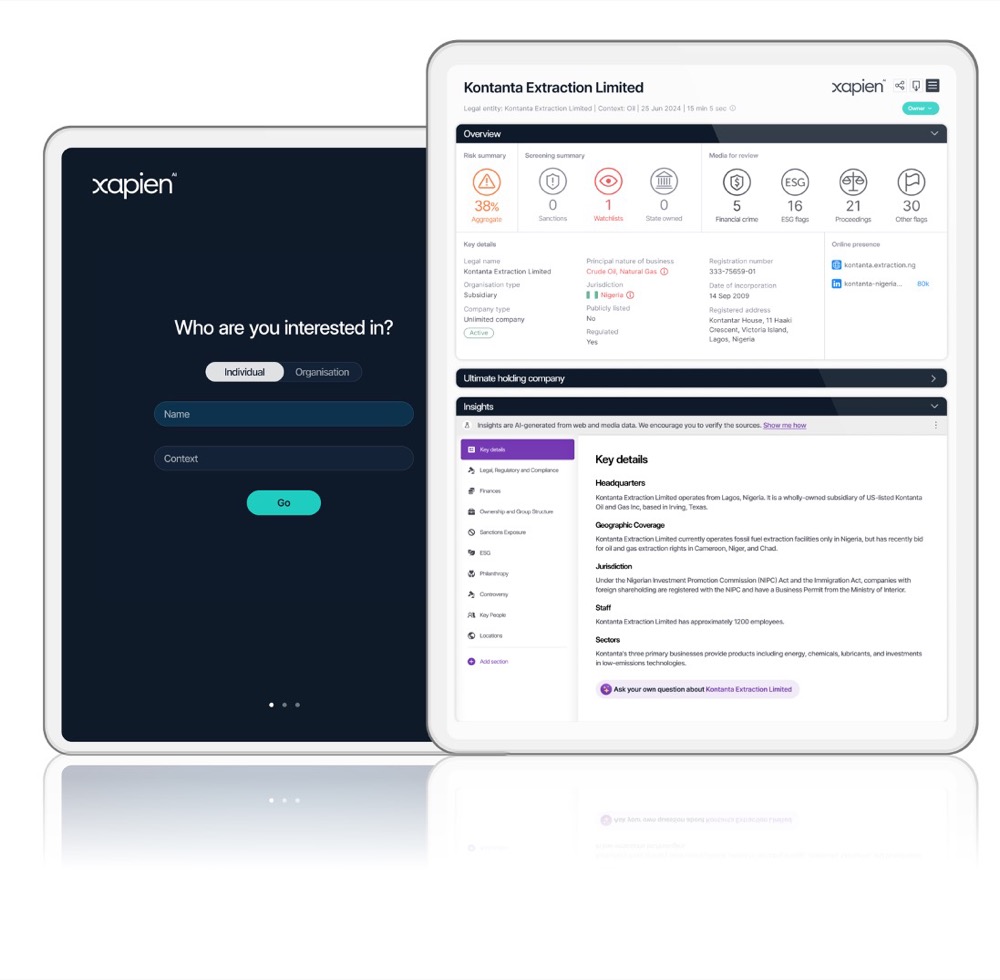

Thorough due diligence is essential for risk mitigation and informed decision-making. Artificial intelligence has revolutionized this process by enabling efficient identification, assessment, and verification of crucial information. Xapien is an AI-driven platform that offers cost-effective research reports to provide comprehensive insights into individuals, businesses, or organizations. These reports cover background information, capabilities, and potential liabilities. The platform’s AI technology analyzes both structured and unstructured data sources, delivering a holistic view of third parties within minutes, significantly faster than traditional methods. Since its last funding round in March of the previous year, Xapien has achieved impressive growth including increasing ARR by over 150% and doubling its headcount to 45. Given the widespread demand across various sectors and industries, Xapien aims to broaden its services to new markets, focusing on both sector-specific and geographical expansion.

London TechWatch caught up with Xapien CEO and Cofounder Chris Green to learn more about the business, the company’s strategic plans, latest round of funding, and much, much more…

Who were your investors and how much did you raise?

Xapien secured $10M (£8M) in Series A funding round led by YFM Equity Partners to enhance its AI-powered due diligence platform, bringing total funding to $17.8M (£14M).

Tell us about your product or service.

Xapien is using AI technology to revolutionises due diligence, delivering rapid, cost-effective research reports, to global businesses on their third parties. We are transforming due diligence from a time-consuming, manual process into an efficient, precise, and comprehensive solution. Xapien is setting new standards in compliance, helping organisations worldwide to navigate complex regulatory environments with ease and confidence, ultimately creating better business practices and stronger ethical standards.

What inspired the start of Xapien?

We founded Xapien to bring transparency to business relationships, so that organisations of all sizes can truly know who they are working with. We are transforming due diligence from a time-consuming, manual process into an efficient, precise, and comprehensive solution. Xapien is setting new standards in compliance, helping organisations worldwide to navigate complex regulatory environments with ease and confidence, ultimately creating better business practices and stronger ethical standards.

We founded Xapien to bring transparency to business relationships, so that organisations of all sizes can truly know who they are working with. We are transforming due diligence from a time-consuming, manual process into an efficient, precise, and comprehensive solution. Xapien is setting new standards in compliance, helping organisations worldwide to navigate complex regulatory environments with ease and confidence, ultimately creating better business practices and stronger ethical standards.

How is it different?

Global business today are facing a perfect storm with two driving factors.

First, consumer today have access to more information than ever about the businesses they buy from, and they care more than ever about the ethical conduct of those businesses. At Xapien we talk about “the rise of the conscious consumer. People expect ethical conduct and supply chain management from the business they buy from and invest in. They vote with their wallets.

Second, global instability (Ukraine, Middle East, tensions with China), leading to increasingly unstable regulation. Rapidly expanding sanctions lists now affect far corners of the supply chain.

This creates an increasing need for organisations of any size to truly ‘know’ their third parties – their customers, suppliers, donors, applicants and investors. Firms no longer simply ask ‘can we’ be in business with someone (a straight compliance question). They ask ‘should we’?

Existing risk & compliance tools (Worldcheck etc) don’t help to answer this question. They just answer a tick box yes/no “are they sanctioned or not?”. To truly know your customer you need research of the type that until recently only hours of manual research could provide (searching and researching on Google to find meaningful, relevant information about your subject takes hours). Using AI, Xapien can deliver fully sourced research reports on individuals and entities worldwide in minutes, not days, and at a fraction of the cost.

Our sophisticated use of AI, to fuse structured and unstructured data sources ensures that our clients don’t have to compromise on accuracy and depth to ensure breadth of reporting. AI means you can check you risks, and get a broader, holistic view of your search subject in minutes, not days.

Xapien is not only responding to today’s business needs but setting new standards in compliance and corporate transparency, ultimately creating better business practices and stronger ethical standards.

What market you are targeting and how big is it?

Ultimately any industry – all businesses internationally need to know who they’re in business with. That said, at this phase in our growth we need to be strategic. Our primary target markets today are highly regulated sector (such as financial services and law firms); large corporations with complex supply chains; and industries that are sensitive to reputational risk (such as philanthropy). At the moment we are targeting the UK and the US but our system is designed to cater to a global audience.

What’s your business model?

We charge annual subscriptions and are modeled on annual recurring revenue targets.

How are you preparing for a potential economic slowdown?

Our B2B product is designed to increase efficiency and drive down costs. This means we are perfectly position to thrive in an economic slowdown, when organisations are looking to cut costs and increase efficiencies.

What was the funding process like?

We used Xapien to do due diligence on our investors which helped!

What are the biggest challenges that you faced while raising capital?

Raising capital requires a huge amount of founder attention and time which is challenging for a small organization that is time pressured and needs to focus on growing the product and the customer base.

What factors about your business led your investors to write the cheque?

Our technical moat combined with our proven product-market fit in key sectors. Since its last investment in March 2023, Xapien has seen remarkable growth. Annual recurring revenue grew by over 150%. In the past 15 months Xapien has secured major partnerships with industry giants, and engagements with Magic Circle, Silver Circle and AmLaw 100 law firms, as well as major players in risk consulting and private wealth. In the philanthropic sector, Xapien has grown its client base by 300% over the past 18 months.

What are the milestones you plan to achieve in the next six months?

We’re at a stage where we need to plan 18 months ahead. This investment will enable us to continue to redefine how businesses understand their third parties. It will do so by accelerating the development of our next- generation entity resolution engine, which includes advanced native language processing, integrations with top data suppliers, new enterprise features, and a continuous monitoring solution for “perpetual Know Your Customer (KYC).”

Additionally, Xapien will use the funds to continue expanding into new sectors, such as financial services and large corporate partners, and grow its footprint in the US.

We’re really excited for this next chapter.

What advice can you offer companies in London that do not have a fresh injection of capital in the bank?

Don’t overhire. You don’t want to be one of those companies who has to let people go within a few months of raising funding. Look for efficiencies – where can automation help you to drive down costs? Time is money, so if something can be done quicker via automation then jump on that. Prioritisation is critical for a small business. Only focus on what is truly necessary, not just beneficial.

Where do you see the company going now over the near term?

We have big ambitions – exponential growth via our entry into new verticals and a big push into the North American market. We think Xapien will become a verb and it will be negligent not to have Xapiened your third parties.

What’s your favourite outdoor activity in London?

We have the best company socials – indoor and out. We’ve gone go-carting, bouldering, done karaoke… but my two favourites were when we just went to the part and played rounders and volleyball. Sometimes it’s the simple things…