Both London VC deal count and value have moved into record territory in 2020 with increases in deal size with a strong finish to the year in Q4

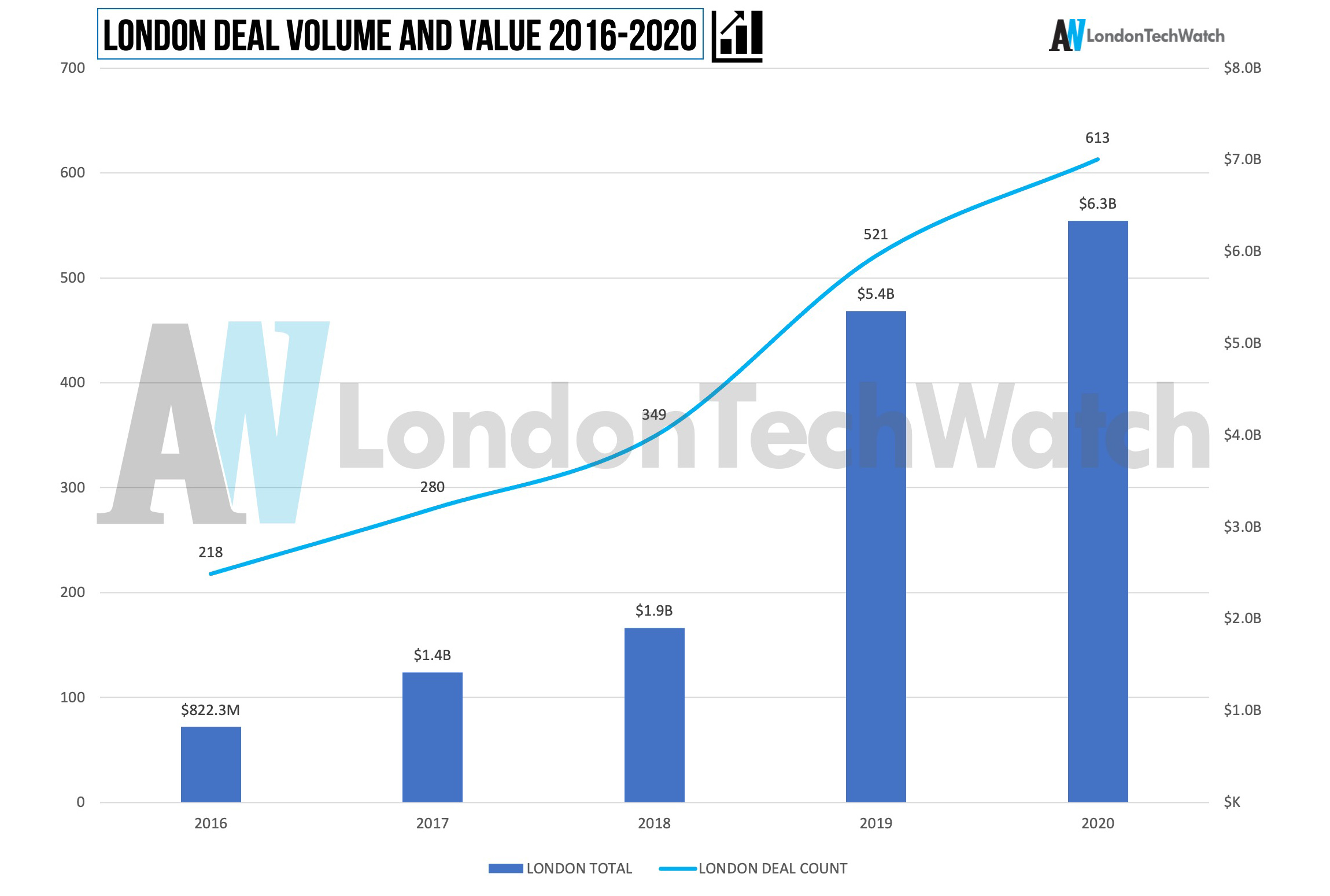

Despite the challenges faced as a result of the pandemic, London startup activity was remarkably resilient. By the end of 2020, the venture capital industry deployed $6.3B in LA-based startups, the highest total on record, driven by strong activity across Early-stage and Series A funding. 2020 funding figures surpassed the $5.4B mark in 2019, representing an 18% growth year-over-year. Quarterly funding levels for the first three quarters were nearly identical to 2019 levels and Q4, despite new lockdowns, was extremely strong; up 74+% from the previous year.

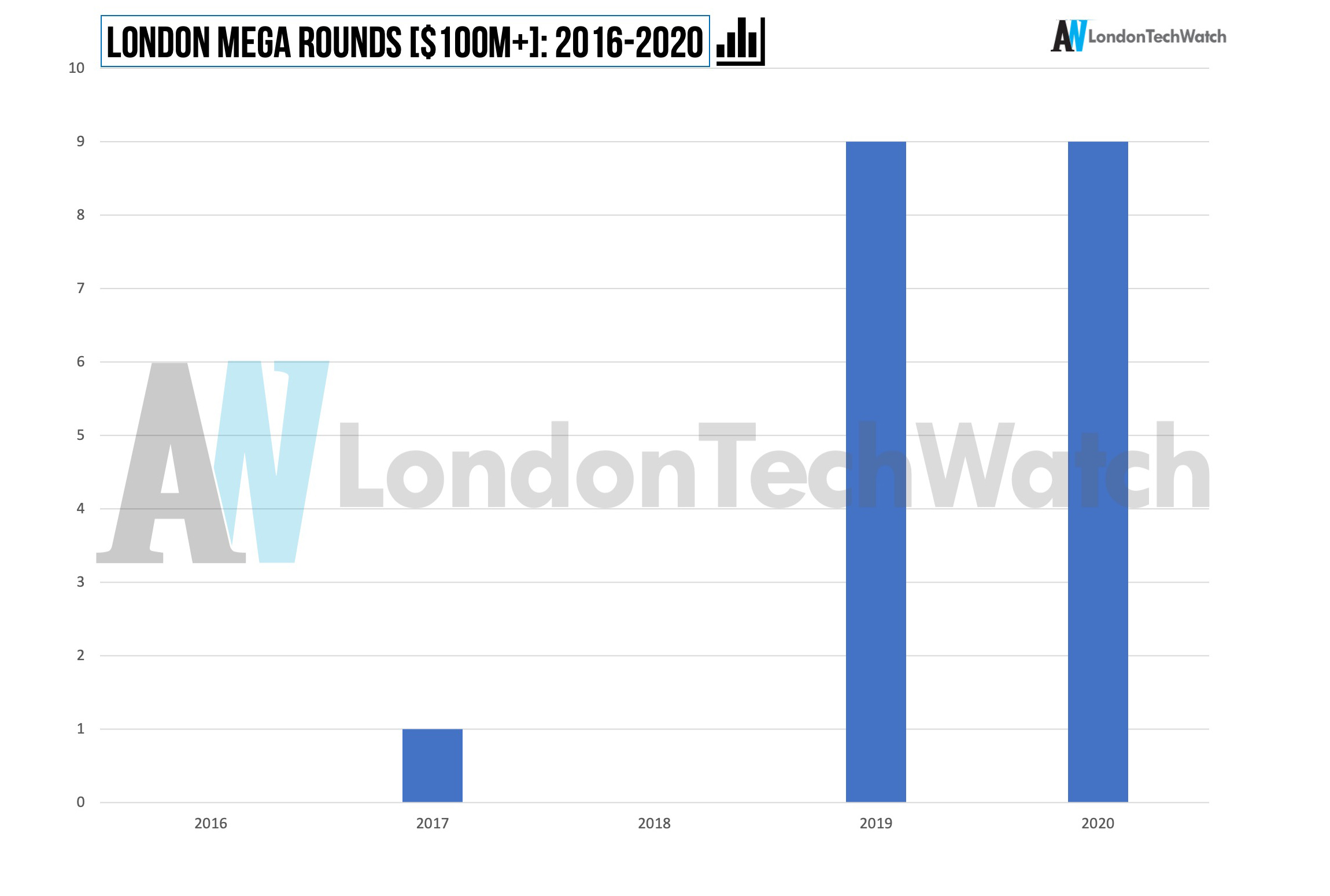

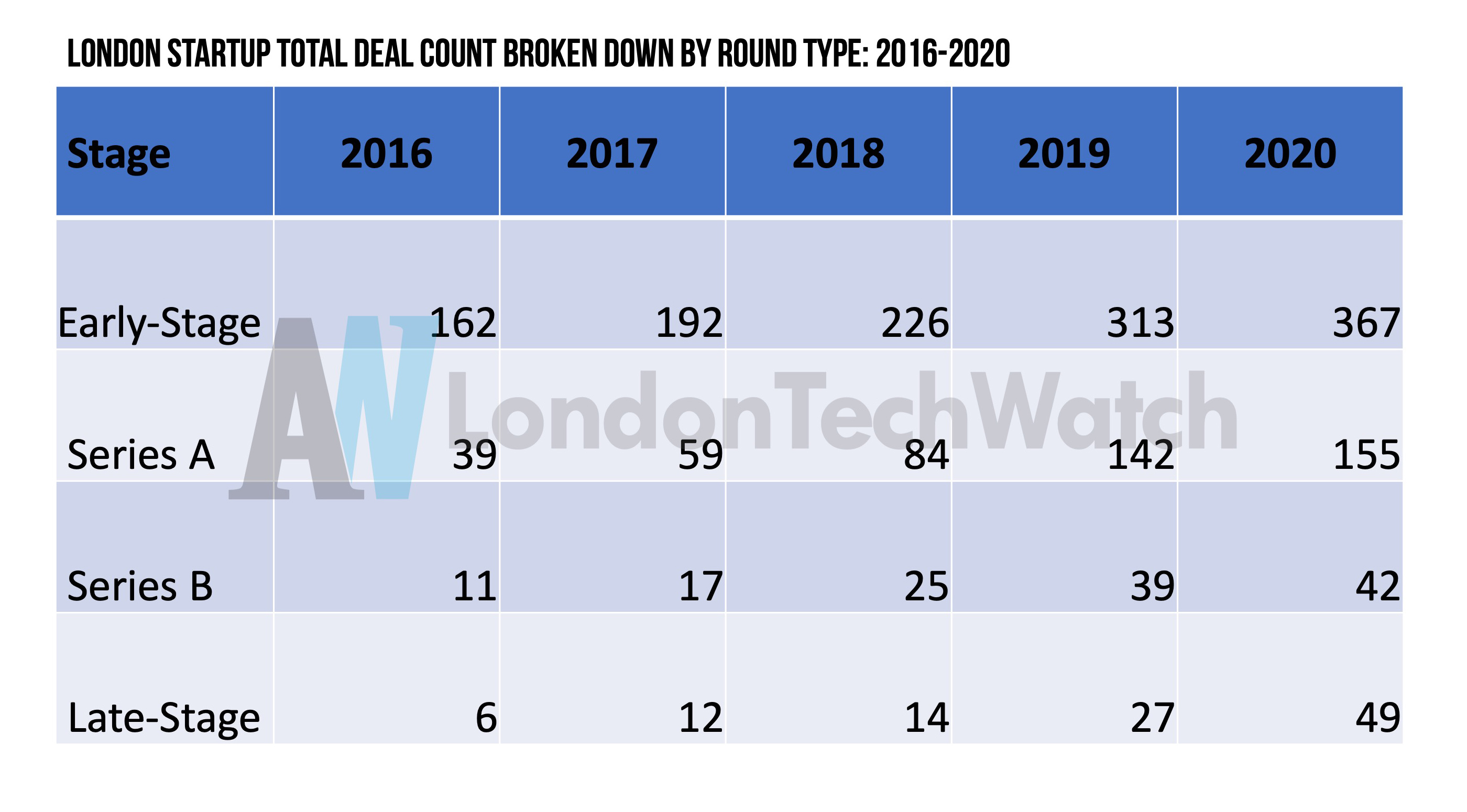

613 companies were able to raise funding in London in 2020, an increase of 18% from 2019. There were 9 mega ($100M) funding rounds in the city, the same as from 2019. These mega deals represent $1.5B or 24% of all capital raised.

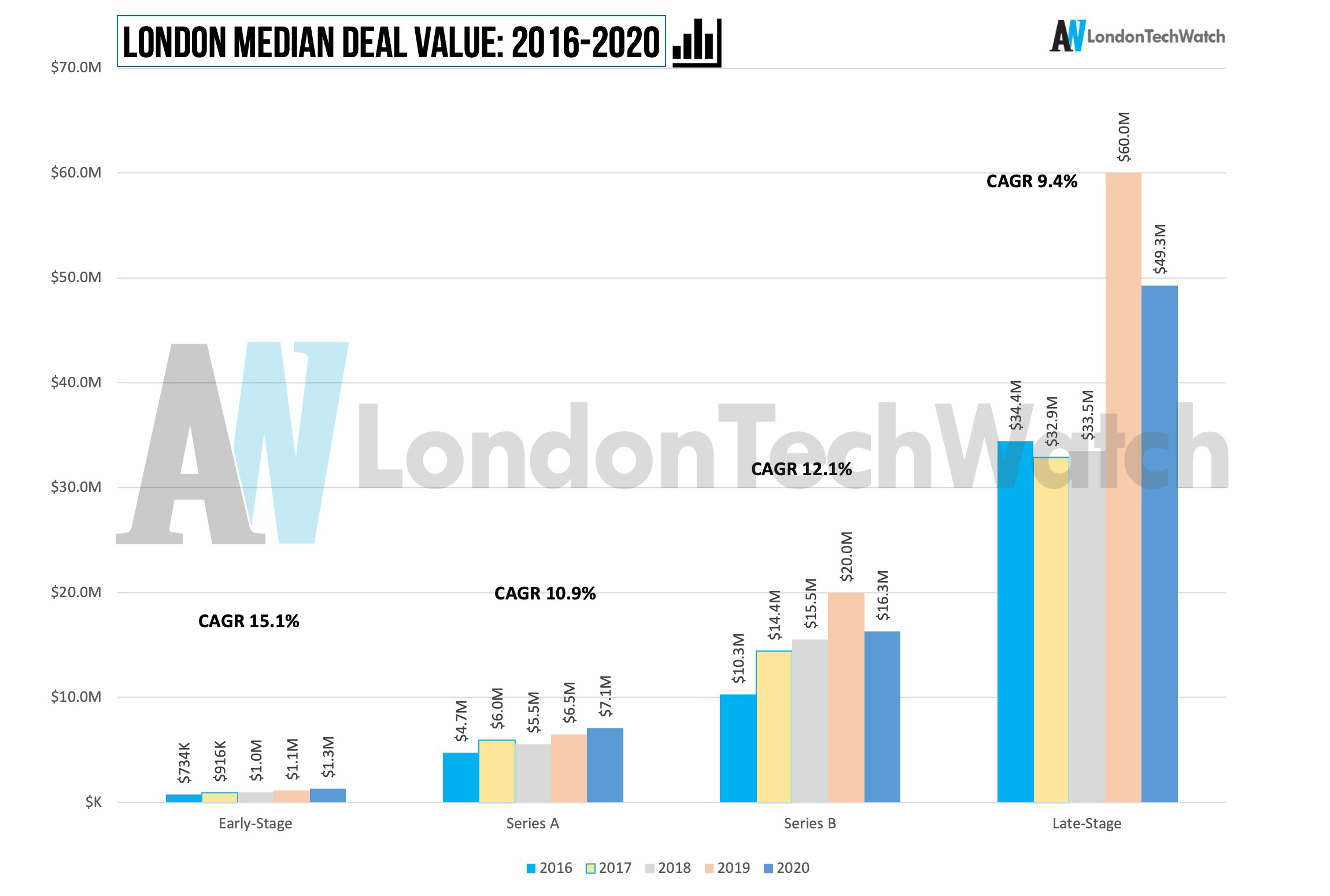

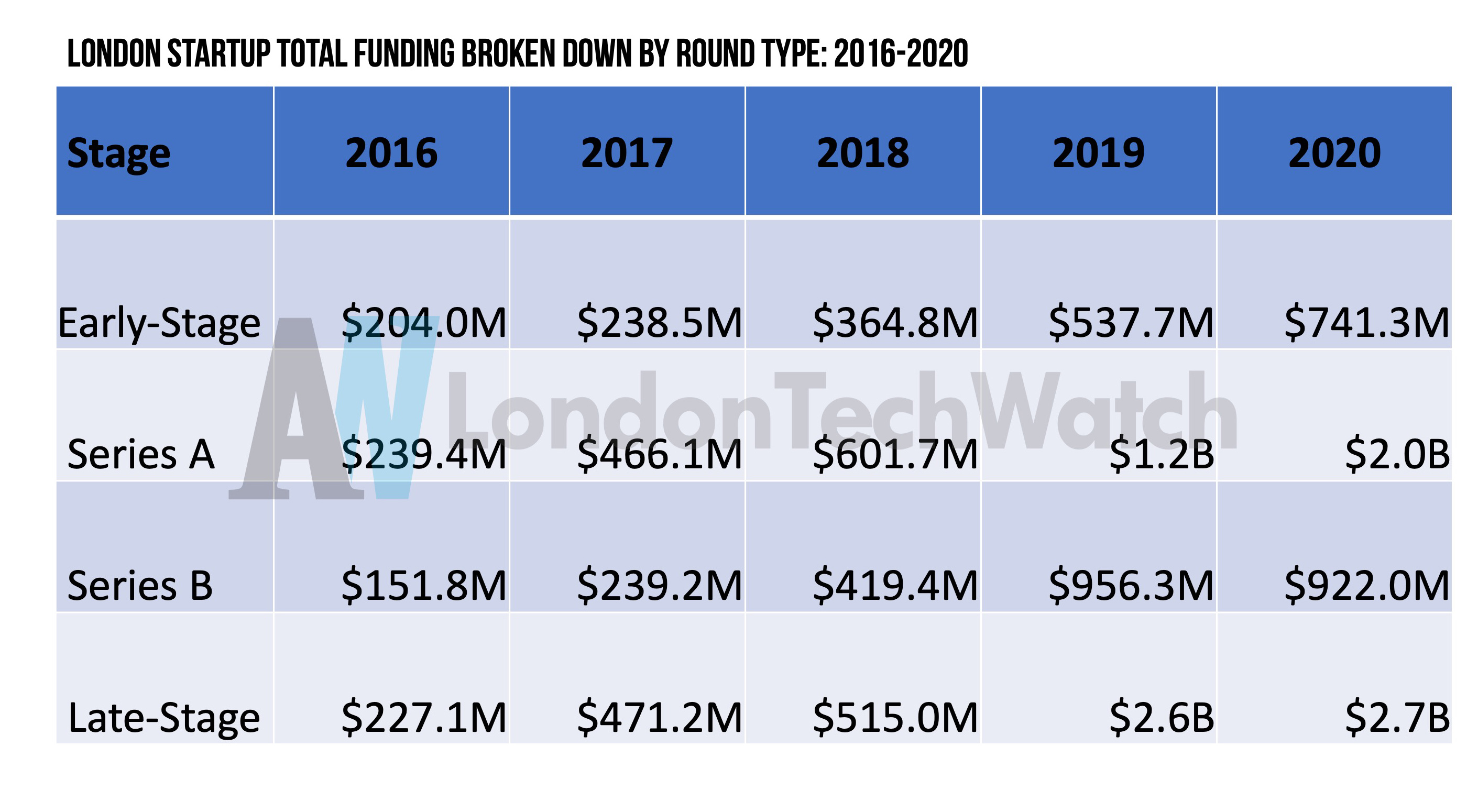

Total funding across all stages with the exception of Series B was up in 2020 with particular strength with a 58% increase in Series A funding year-over-year, driven by large rounds for Karma Kitchen and Molo, and a 38% in early-stage funding with a record number of companies able to raise funds. What makes this more impressive is that founders for early-stage ventures typically have difficulty raising for businesses that are not fully established and even more so when doing it virtually.

2020 was a breakout year with resilient strength in the venture market serving as a foundation. Let’s take a deeper dive:

London Venture Capital activity in 2020 hit a record level in terms of both investment amount and number of deals.

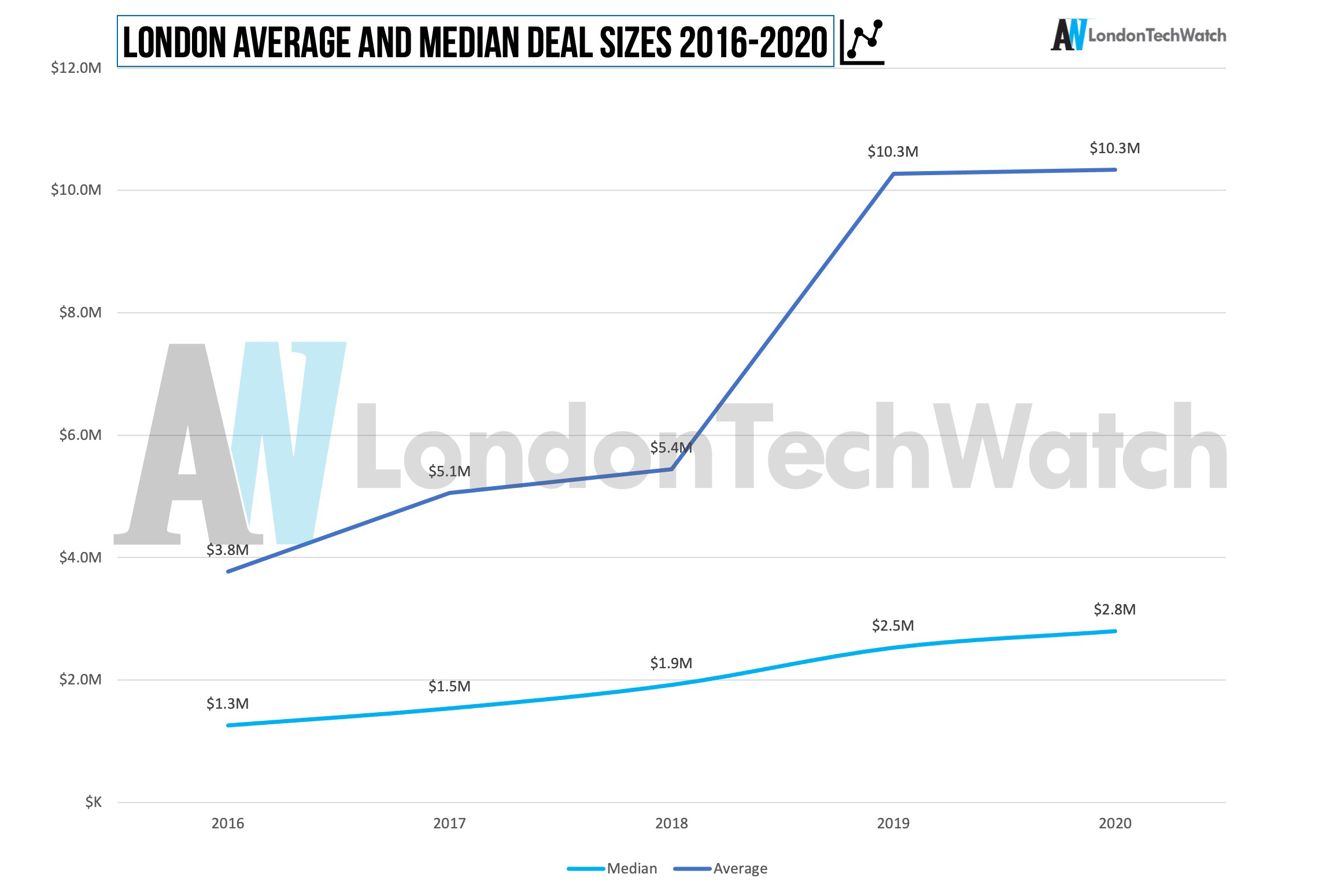

Investors did not shy away from London startups despite the pandemic as there was very little difference in median and average deal sizes. The growth was largely driven by the number of companies receiving funding.

Median deal sizes fell at the later stages bucking trends in other markets. There was nominal growth at the earliest stages.

The number of mega-rounds ($100M+) stayed the same in 2020 but these nine deals represented 34% of all London startup funding for the year.

A look at all the numbers year-over-year.

Notes:

- Only equity financings were included.

- This analysis, unlike others, in order to maintain a focus on tech-enabled startups does not include biotech startups, lending institutions, and real-estate transactions where capital requirements are significantly different.

- Early-stage rounds consist of rounds classified as pre-seed, seed, angel, and convertible note fundings <$10M.

- Late-stage rounds consist of rounds classified as Series C and any subsequent rounds. Unclassified venture rounds over $25M are included in late-stage.

Make an impact on your bottom line and drive leads in 2021!

The London TechWatch audience is driving progress and innovation on a global scale. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement, lead generation, and thought leadership in front of an audience that comprises the vast majority of key decision-makers in the London business community and beyond. Learn more about advertising to London Tech, at scale.