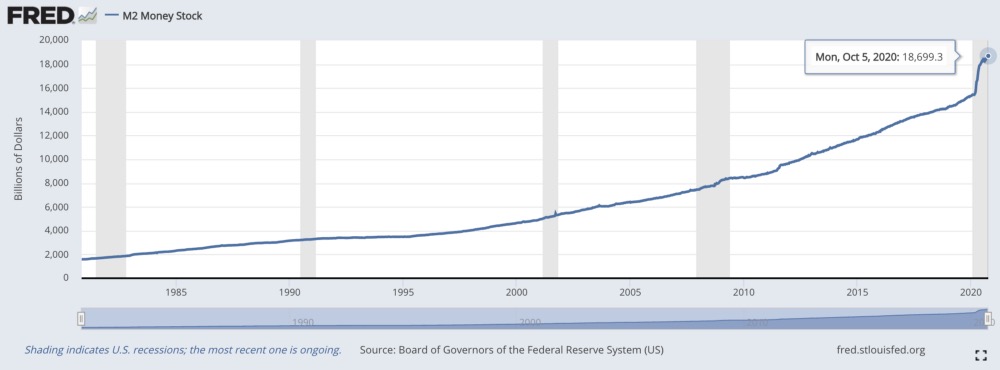

The bad, tragic news is ….. we are in the midst of the greatest flood in the history of humanity:

Over the last seven months, the “rain” of cash from hurricane “Fed” has averaged $15 billion a day, every…. single….. day. That’s 7.9X the rate at which hurricane Fed averaged raining cash over the previous (very very rainy) decade (2010–2020), 15.6X the (very rainy) decade before that (2000–2010), and 30.5X the (rainy)decade before that (1990–2000). Hurricane Fed is generating a flood of biblical proportions.

And a flood of fiat is spewing forth from every central bank in the world.

But the good news is, we have an Ark that anyone with foresight can climb aboard to avoid the flood. That Ark …. is bitcoin.

While others are drowning in the flood of currency, I have faith that the Bitcoin Ark, made from math and science, will float and save all aboard from the flood. But 99.9% of the world either doesn’t know there’s a flood, or doesn’t care about the flood, or doesn’t think there’s anything they can do about the flood. So we have to help them #GetOnTheArk.

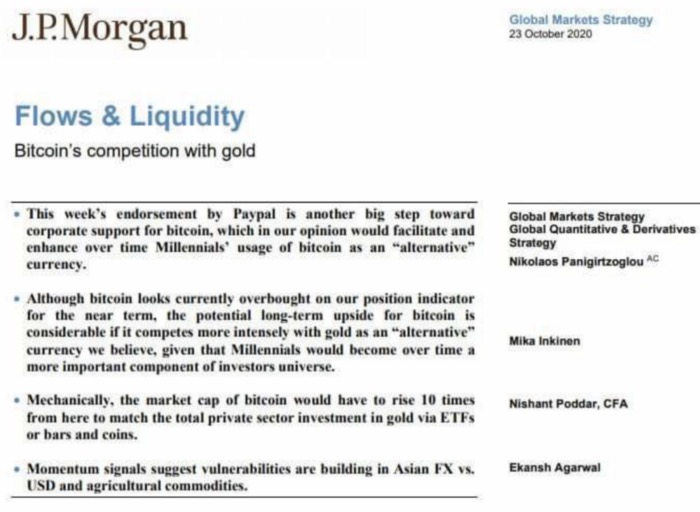

The good news is, we’re getting more help every day. Recently, it was PayPal who announced that they going build a plank to let their 300 million users and 26 million merchants get on the Ark. Even J.P. Morgan recognized that it was another “..big step forward” for bitcoin:

As did legendary investor Paul Tudor Jones, who is increasingly bullish on Bitcoin believing the current rally is “… in the first inning.” Public companies like MicroStrategy and Square are starting to put balance sheet cash into bitcoin.

And the awesome thing is, the more people who get on the Ark, the stronger and more resilient the Ark becomes. As more people get on the Ark, it will not only survive, it’ll thrive. So it’s in our collective best interest to help as many people as possible appreciate that the Ark exists and to #GetOnTheArk.

Accurately Predicting The Future Values of Assets is Hard

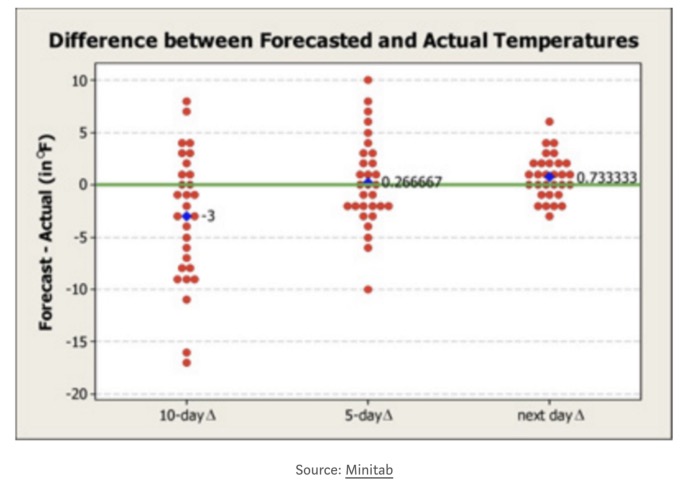

Humorously, I don’t think predicting the price of Bitcoin is a thing. Two years ago I wrote “The Two Reasons Why The Forecasts For Bitcoin YE 2018 Were So Horribly Wrong”, because like predicting the weather (see below), there are just too many variables to accurately predict out very far.

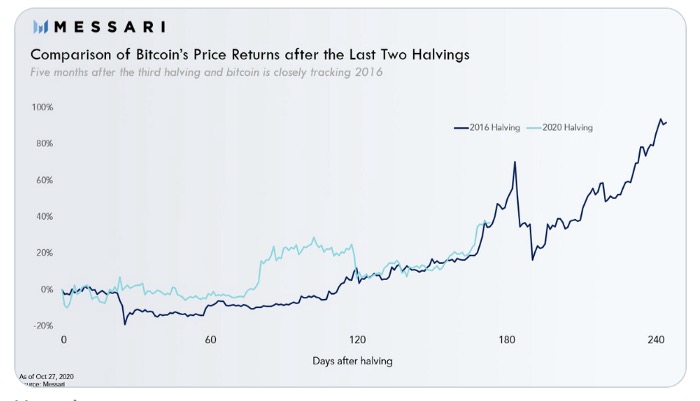

That said, the price performance of bitcoin post the halving has eerily resembled the price-performance post the previous halving in 2016.

And we all remember how bitcoin did for the following year!

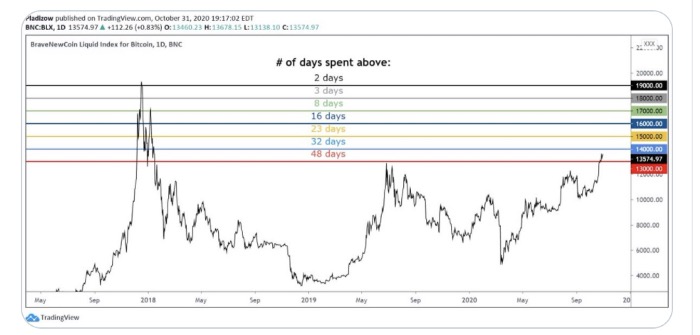

And Bitcoin is already at levels seldom seen before:

With the recent celebration of Bitcoin’s 12th birthday, I highlight this post by Nic Carter “Bitcoin at 12” to give you additional perspective on why you should be uber bullish.

My market cap target for bitcoin is $2 Trillion, or $100,000 per bitcoin ever to be mined. This target is predicated on bitcoin growing its market share of store of value from 2% today to 17% by 2024 (assuming gold holds its current market cap of $12.5 trillion).

Could bitcoin surpass gold in value? Sure! But 17% appears, to me, to be a reasonable forecast for the market share of the #2 player in store of value. I recognize that every industry has different dynamics that drive different market shares for the #2 player. While perennial #2 in soft drinks, Pepsi, has a 24.1% market share, Bing, #2 in search, has just 2.8% share. Safari’s the #2 browser with a 16.7% share. Time will tell if 17% was too high, or too low, but it feels reasonable to conservative to me today.

While $2 trillion is a hard number to comprehend, I get comfort by the fact that Apple trades at a $2 trillion market cap today. So we know that things can grow to that level in value.

There is no magic to the 2024 date/4 years out. Others see it getting there faster. I’m taking longer because of my belief in Amara’s Law, which states that the impact of all great technology is overestimated in the short run and underestimated in the long run. Which is just a fancy way of say shit takes time.

There is also no magic to the 20M bitcoins used to get a price target. There have been 18.5 million bitcoins mined to date. It’s estimated that 3–4 million of those are lost. And we have another 2.5 million to be mined. So 20 million is simply a round number that most will find conservative.

I’ll see you on the Ark!