It’s only been five years since Sumsub was founded and its already established itself as a leader in identity verification across a number of verticals including fintech, gaming, transportation, and trading. Sumsub’s AI-based identity verification software automates 95% of the customer onboarding process and is trusted by AML/KYC (Anti-Money Laundering/ Know Your Customer) service providers to provide a range of compliant- solutions. Sumsub has already been used by 600+ businesses with no plans to slow down as the identity verification market is expected to grow to €20B by 2022 with a variety of use cases that is ever-increasing as the pandemic drives digital transformation.

London TechWatch caught up with Founder Jacob Sever to learn more about Sumsub, the technology infrastructure powering the platform, and the company’s latest funding round.

Who were your investors and how much did you raise?

We’ve raised a $6M Series A round led by MetaQuotes, the leading developer of financial trading software. Our $1M Seed round was led by Flint Capital and Ilya Perekopsky, VP of Telegram messenger.

Tell us about the product or service Sumsub offers.

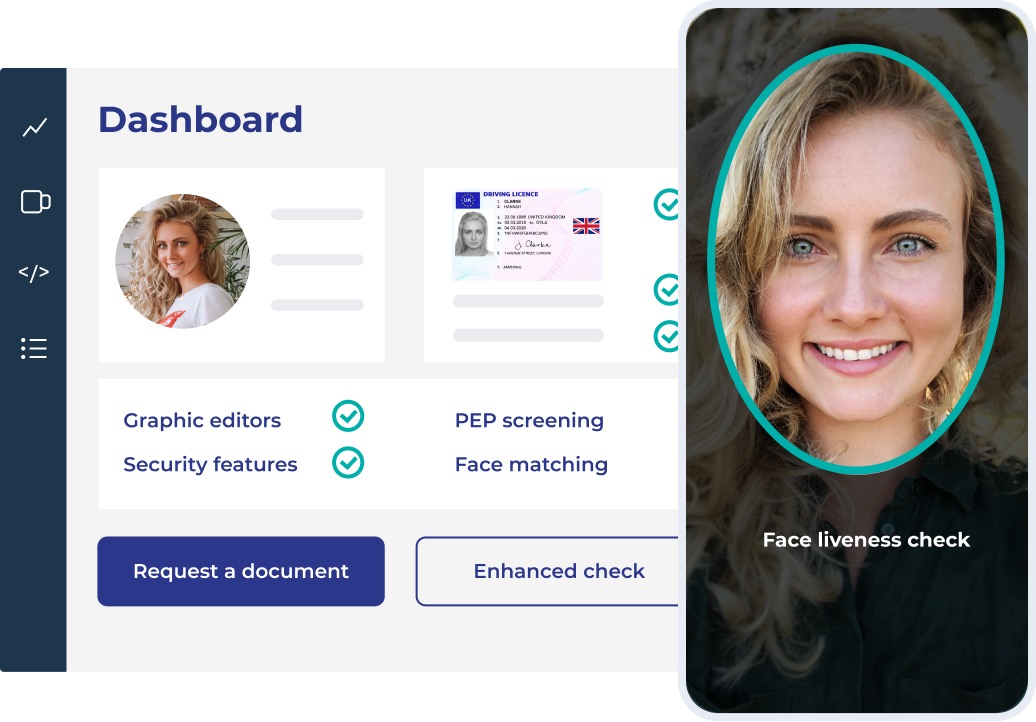

Sumsub is an identity verification platform that provides an all-in-one technical and legal toolkit to cover KYC/KYB/AML needs. The company focuses on accelerated ID verification, digital fraud detection, and compliance for over 200 markets. Sumsub employs top market technologies combined with legal expertise and assistance with financial requirements (FCA, CySec, MAS, FINMA, BAFIN, etc). Clients include BlaBlaCar, Gett, ESL Gaming, JobToday, Wheely, Vk.com, Decta, Exness, Bank Dobrobyt, HRS Group.

What inspired the start of Sumsub?

What inspired the start of Sumsub?

In 2015, my brothers and I released the first version of our anti-fraud forensic software. Based on machine learning algorithms, it analyzed fraud patterns for our first clients — insurance companies and local banks.

After an invitation from Belkasoft Evidence Center, Sumsub’s team got to examine cases for international intelligence services and police agencies. It became clear then, that merely investigating was not enough. Many life and health-threatening cases of digital fraud could have been prevented by an accurate identity and anti-fraud check.

To help solve the problem, in December 2016, Sumsub developed a user-friendly identity verification solution that could resist all corner cases, such as bad document quality and fraud.

How is Sumsub different?

Instead of offering a single-task oriented solution for compliance, anti-fraud, or customer support, Sumsub developed a unique all-in-one toolkit, that can cut up to half of all compliance costs (according to the COO of Exness), securing financial, trading, gaming, and e-commerce companies against possible regulatory penalties and reputational risks.

Current, classic compliance and anti-fraud solutions are fragmented. There are two options for businesses now: to build their own manual process inside a company or to integrate multiple segmental solutions (EDD, AML data, identification, legal support, lifecycle management). We’ve had many complaints from the developers of companies who jump from one solution to another – these solutions are costly, unmanageable, and inflexible for global companies with different workflows for different users. Because of this, companies either skip fraud altogether or do strict checks that drastically lower conversion rates.

Unlike other solutions that automatically accept or reject applicants, we allow our clients to review the ambiguous cases and make the decisions on the applications themselves. We offer an end-to-end solution for these companies, helping them to adjust compliance procedures, provide analytics, compile the necessary set of checks, and customize user flows.

What market are you targeting and how big is it?

The identity verification as a service market has been estimated to grow from €10B in 2017 up to €20B by 2022, with an estimated CAGR of 9-15%. (McKinsey, 2018).

McKinsey distinguishes financial services as the main driver of the identity verification market (making up 28% of the total market). The financial services market is a quickly growing sector, made up of $34.5B across 1,913 deals (CBInsights, 2019) with 67 venture capital-backed fintech unicorns worth a combined $244.6B (CBInsights, 2019). Besides, more and more people are beginning to use financial services in their daily life. Globally, at least 69% of adults—3.8 billion people—now have an account at a bank or mobile money provider. This is up from 62% in 2014 and just 51% in 2011. From 2014 to 2017, 515 million adults obtained an account, and 1.2 billion have done so since 2011, according to the Global Findex database (Global Findex Database, 2017).

Apart from the market of financial services, we also cover telecommunications, retail, ride-sharing, and crypto, which all add up to additional 28% of our target market of identity verification, totaling at 56% (McKinsey, 2018). Other markets that require verification are gaming, trading, marketplaces, and B2B sectors.

What’s your business model?

We are B2B and offer either a SaaS monthly subscription or a pay-per-check pricing model.

How has COVID-19 impacted the business?

At the very beginning of the pandemic, we took a slight downturn and saw a reduction in the number of checks due to a drop for demand in the transportation industry and some other offline-based industries, as well as in those markets that expressed general concerns over the situation.

Having said this, the decline did not last more than two months, and we ended up experiencing exponential growth in all key metrics that outshone our expected growth.

What was the funding process like?

We met with multiple investors, discussed the terms of the potential initiative and the benefit that they can bring to our business. As a result of these meetings, we were able to select a strategic investor who fit our business the most.

What are the biggest challenges that you faced while raising capital?

The final steps of securing the funding round were during the pandemic. This made communication slightly difficult as we were unable to meet face to face with our investors.

What factors about your business led your investors to write the check?

MetaQuotes saw our value as the superior solution on the market, in terms of functionality and technical execution. With this in mind, they decided to participate in what we do and give us the support we need in order to grow.

What are the milestones you plan to achieve in the next six months?

- Code-free customization. This will give you more freedom to customize user flows, in addition to the look of verification journeys and their rules, all without involving your developers.

- Higher effectiveness. We will expand our product functionality across the board to improve effectiveness. That means improvements will take place in departments such as compliance, anti-fraud, support, product, and many others.

- More powerful AI. We will reinforce our AI department to give you even better recognition quality, anti-fraud detection, verification speed, and accuracy of processing for local languages.

- New checks and features. We will introduce new types of checks and helpful features based on the needs of our clients and the industries we are working with now.

- Enhanced anti-fraud. We will focus on delivering best-in-class anti-fraud solutions, making sure we are always ahead of those with ill intentions.

What advice can you offer companies in London that do not have a fresh injection of capital in the bank?

We would encourage companies to focus on the industries that are growing during the pandemic—gaming, financial services, health and every other area of business that has the potential to thrive online.

Where do you see the company going now over the near term?

We already have a good foundation with ride-sharing industries (BlaBlaCar, Uber, Gett/Uno, JobToday), fintech (Decta, Philip Bank), trading (MetaQuotes (the developer of the ‘MetaTrader’ trading platform), Exness, IQOption, Olimp Trade, Alpari), gaming (KingsWin, ESL Gaming) and crypto (Bitcoin.com, Exmo, CoinPayments, Cryptopay, Polymath). We plan to pursue short-term expansion through avenues of existing clients, partners, investments, upcoming events, and current digital marketing campaigns. We are also going to be focusing on enterprise projects while working towards doubling our client base.

What is your favorite restaurant in London?

There’s a Greek restaurant, just off Marylebone Highstreet, called Opso. They offer fantastic, authentic, and high-quality Greek food. The service is quick, and it’s a paradigm for ‘no-stress’ dining. You can also sit outside, and you’ve got a lovely view of a relatively quaint Victorian street. That’s my favourite, for sure.

You are seconds away from signing up for the hottest list in London Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today