Securities lending has traditionally been accessible to big financial institutions, but every owner of stocks, bonds and ETFs has the right to lend them. Sharegain makes securities lending transparent and accessible to individual investors through its cloud-based, real-time and data-driven platform. The platform is bank agnostic and it can connect to almost any bank or broker, which eliminates the need to switch between banks and brokers in order to delve into securities lending, reducing any sort of friction or barrier. The largest financial institutions in the world have been capitalizing on securities lending and now for the first time ever, retail investors can access the same lucrative opportunities markets with ease, convenience, and simplicity through Sharegain.

London TechWatch spoke with founder and CEO Boaz Yaari about the company, how its bringing transparency to the age-old securities lending ecosystem, the company’s future plans, and the latest round of funding, which brings total funding raised to $12M across three rounds.

Who were your investors and how much did you raise?

Sharegain has raised $12M in funding to date. The initial investment came over two rounds – with the most recent being a $5M Series A-2 round. We’re grateful to have a set of strong, globally-focused investors on board who share our vision – these include a combination of leading VC firms (Blumberg Capital, Target Global, Maverick Ventures Israel, and Rhodium) as well as family offices and private investors from the finance industry.

Tell us about the service Sharegain offers.

Sharegain is bringing the sharing economy to Capital Markets and is democratising the $2.5T lending industry. We enable private investors to lend their securities and enhance their returns just like big financial institutions have been doing for decades, effectively bringing the ‘Airbnb moment’ to the stocks, bonds, and ETFs of private investors.

What inspired you to start Sharegain?

What inspired you to start Sharegain?

Having spent over a decade in capital markets, as a trader and portfolio manager, I kept coming across securities lending as one of its ‘consumers’. I was quickly frustrated and equally fascinated by its unique attributes, which resulted in massive opaqueness and multiple inefficiencies and bottlenecks that were a deterrent to new players and an inhibitor to its growth.

The more I dug-in and learned about securities lending, I realized it was ripe for technological disruption, and there was a huge opportunity for a much larger group of people to enjoy the returns that securities lending can generate.

How is Sharegain different?

Prior to Sharegain, securities lending was considered the last bastion of old-tech in capital markets, meaning that access for private investors was largely restricted.

Securities lending is an OTC, relationship-based, opaque ecosystem that is driven by systems designed 15-20 years ago, so the incumbents still operate similarly to the way they did 40 years ago.

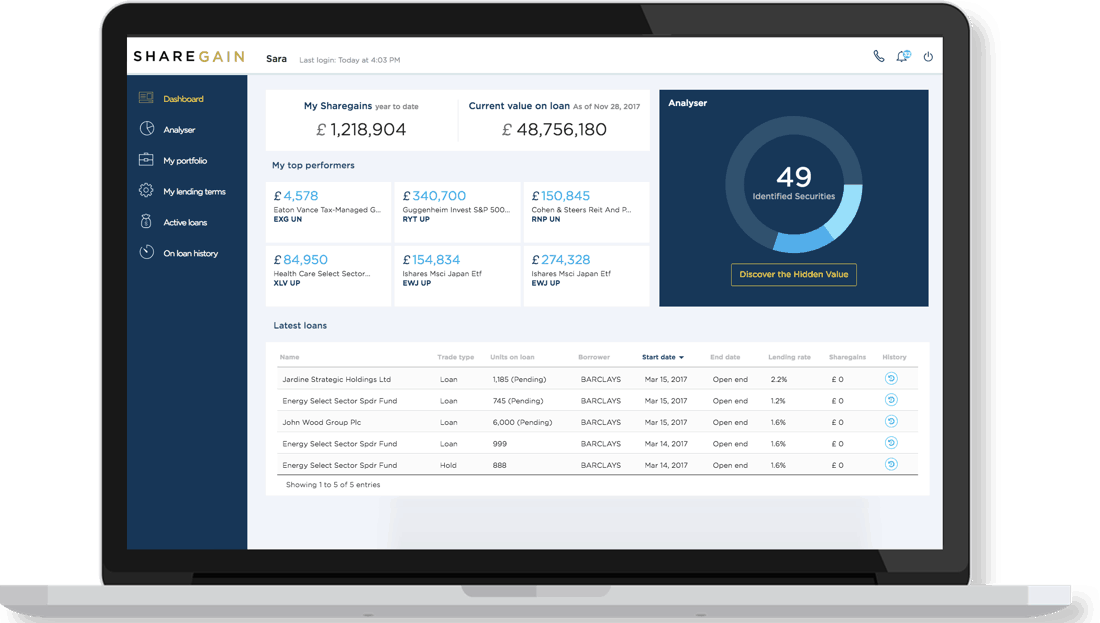

Sharegain is a cloud-based, real-time and data-driven platform. We are bringing a new approach to an old industry and driving wider adoption through technology, and Sharegain is doing all of this while delivering high standards of transparency, ease of use, and extreme focus on customer experience.

Sharegain is not a bank or a broker with an app. We are a pure tech solution that is effectively a bolt-on to your investment account. We are bank-agnostic and can connect to almost any bank or broker, eliminating the need to switch between banks and brokers in order to activate the solution.

Sharegain is not a bank or a broker with an app. We are a pure tech solution that is effectively a bolt-on to your investment account. We are bank-agnostic and can connect to almost any bank or broker, eliminating the need to switch between banks and brokers in order to activate the solution.

We are also not a trading app, as we acknowledge that time is an investors’ most valuable commodity and they wouldn’t want to spend it operating your securities lending activities. Therefore, we’ve created an end-to-end solution that effectively does all the work for our customers, whilst they retain full control and complete transparency overall processes.

What market you are targeting and how big is it?

The current value of securities on loan in the securities lending industry is $2.5T (IHS Markit, 2018).

Notionally, every owner of stocks, bonds, and ETFs has the right to lend them. However, for decades the practice has been largely confined to big financial institutions who have made billions of dollars every year from renting out their securities. Globally there are over $40T of stocks, bonds, and ETFs sitting idle and collecting dust instead of collecting income. They belong mainly to private investors (through their banks and online brokers), small/medium asset managers, wealth managers, and robo-advisers that are underserved or completely shut-out of the existing securities lending industry.

By giving these investors access to this industry and its benefits, Sharegain is effectively “growing the pie” and bringing securities lending to its rightful place in the digital age.

For people who remember the fallout of major financial firms -like Lehman Brothers- from the 2008 global financial crisis, how would you convince them to participate in the securities-lending market?

Actually, Securities Lending (using a Triparty collateral manager) performed extremely well in the global crisis and stood the test of time through the defaults of global banks etc. Sharegain has embraced the triparty collateral management model and has brought it to the digital age. In our mind, the global crisis has also changed many things, largely for the better. The short-term shock and long-term regulatory overhaul have fundamentally altered the way investors think and act. More than ever before, they are aware of what they have, the rules they must follow, their rights, and the critical importance of transparency and control.

What’s your business model?

In 2017 we launched our DAL solution (Digital Agent Lender). An end-to-end, world first solution empowering high net worth individuals, family offices, and small asset and wealth managers and enabling them to generate additional returns on assets they already own with no overheads and no upfront cost—while retaining full control and transparency.

In Q4 2018 we launched our enterprise SLaaS solution (Securities Lending as a Service) to meet a growing demand for our solution from large financial institutions. SLaaS allows large asset managers, private banks and global financial institutions to centralise, enhance and effectively outsource their securities lending operations to our platform.

Our revenue model is based on a success fee. No hidden set-up or management fees. You don’t lend, you don’t pay!

What was the funding process like?

Raising money is rarely a quick process. However, driven by a combination of investor demand and good market traction, we spent a relatively short, focused amount of time (around four months) finding the right investors and closing the latest round.

What are the biggest challenges that you faced while raising capital?

Educating investors who are not capital markets savvy about the size of securities lending and the opportunity.

What factors about your business led your investors to write the check?

Firstly, given the uniqueness of the idea, many VCs wanted to meet us. The fact that my team and I have backgrounds in capital markets and substantial subject market expertise in securities lending has definitely been an asset throughout the fundraising process. In addition, combining our capital markets expertise with Israeli tech talent (our R&D centre is in Israel) brought complementing synergies to our team – which was extremely appealing to our investors.

So bottom line, the most important factors are that there is a big potential market, a big existing problem to solve, and a great team to make it happen.

So bottom line, the most important factors are that there is a big potential market, a big existing problem to solve, and a great team to make it happen.

What are the milestones you plan to achieve in the next six months?

In the next 6 months, we aim to increase our client base and expand our reach to become one of the biggest securities lending players in Europe.

What advice can you offer companies in London that do not have a fresh injection of capital in the bank?

If you are a tech company in the UK there are a lot of government initiatives which have been introduced in order to help the startup community as a whole – and fintech specifically. Make sure you make full use of them. In addition, London is very unique because it has become a big market with potential clients in almost every segment of every market. So do your legwork and find your potential clients however possible.

Where do you see the company going now over the near term?

Increasingly, Sharegain’s value proposition is becoming more and more appealing, especially with financial institutions. As such we see Sharegain growing, expanding into new territories (particularly the US) and delivering more monetary value to our clients.

What’s your favourite outdoor activity in London?

Snowboarding and running.