We recently had our mid-year internal review of our funds. In going through our many investments, one factor that emerged was that we have three fundamental “flavors” of investments. We found that we actually use slightly different language when we discuss each of these investment flavors, because our perspective and expectations of the companies are distinctly different.

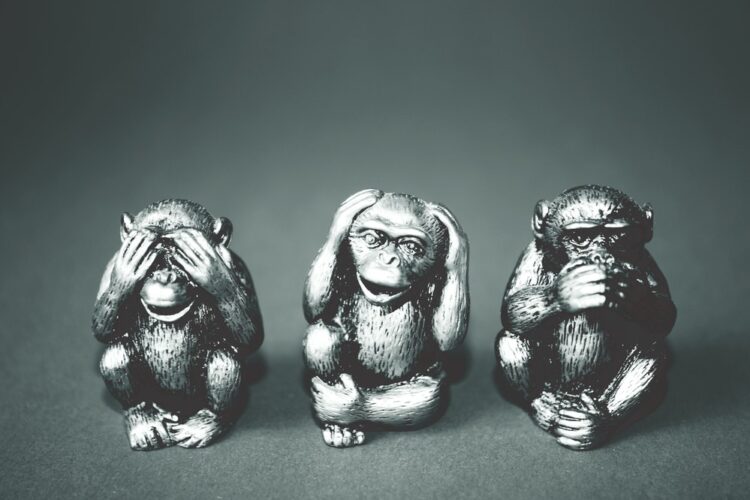

Here are our fund flavors:

Everything is beautiful. These are companies where we feel the stars align. The company is in a key focus area. The CEO is a great person and a great entrepreneur. The tech is differentiated. The market strategy is clear. The path to profit seems short and on a steep upward slope. The terms are reasonable.

The good fight. These are companies where many, but not all, the above key elements seem present. The CEO is fabulous, but the go-to-market is not clear. The team is outstanding, the current business model less so. We see how the team and company could win, but we can also see how it could all come to tears. Here, we’re taking a calculated risk that the team will find a way through. Often, these will be smaller initial investments to initiate the relationship, so we can pound in more money when we see the potential progress fulfilled.

The way in. When we define new areas of investment focus, or when our analytics show that a market has potential but is not yet clearly rising, we will invest in companies for a mix of expected return and learning. Blockchain is a good example. If we didn’t find and study blockchain companies, nor invest in any companies in this segment, when the market eventually frames up and great winners emerge, two things would be true:

1. We would be in no position to know about these developments

2. We would have no bona fides in the segment to help us convince great entrepreneurs we could be helpful, so they take our investment.

By researching actively and investing prudently in emerging areas, we establish the foundations for future investments. Even here, our first priority is return; we need to see how these investments can increase our value; but we’re more focused here on strong downside protections, so we don’t lose money, and on the overall development of our investment posture in the segment. By definition, in these cases, we won’t be in a position to see clearly where a big win might come from.

One interesting note is that our most valuable companies in Social Starts, our more mature fund family, have actually come from the second group, not the first. Our hypothesis is that these companies are compelled to respond to core challenges early in life, and that’s good. We believe the entrepreneurs’ positive response to these challenges, the capacity to drive effective change, as much as outstanding initial circumstances, propels great startup outcomes.